Buying at the foreclosure sale is risky business. Every investor knows that. The property is sold “as is”, and you don’t get a guarantee of clear title. But there are so many inherent risks, it is difficult to list them all.

Today I learned about a new risk. From a long-time investor who had also never run across this situation.

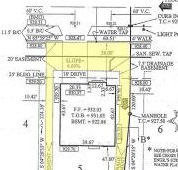

The Survey

Obviously, nobody gets a survey of the property before they buy at the foreclosure sale. Not enough time, and the expense isn’t warranted, especially considering all the potential properties at the sale. I’m not even sure if a surveyor can take your order if you have no interest in the property…

Obviously, nobody gets a survey of the property before they buy at the foreclosure sale. Not enough time, and the expense isn’t warranted, especially considering all the potential properties at the sale. I’m not even sure if a surveyor can take your order if you have no interest in the property…

Well in this case, the investor bought a great house at the foreclosure sale, quickly rehabbed it and immediately got a finance contract to sell the home. It was just about to close.

HOWEVER.

As with every loan, the lender ordered a survey. A survey shows where the improvements are built, and lets the lender know if there are any potential problems like encroachments or easements that might impact the property value.

The Problem

In this case, the survey showed the house encroached into an Underground Utility Easement. By just 12 inches. The builder located the footers of the house in an area reserved for underground power cables. Just a foot off… but it had a huge impact.

The title insurer had no choice but to list the encroachment as an exception to title coverage.

And the lender had no choice but to deny the loan.

So the deal fell apart.

The “Solution”??

“Luckily”, the utility company in question has a process for requesting a partial release of a recorded utility easement.

The application fee is $500, and you wait 12 weeks for their engineer to decide if the home interferes with the underground utilities.

If the home doesn’t interfere, you get a recorded release a few weeks later.

If the home is determined to be too close to the actual power lines, then you pay another $2,000, wait another 12 weeks, and THEN pay for the actual cost of moving the utilities away from the house.

Best case scenario– this problem ONLY cost the investor a full price sale, $500, and four months of waiting.

Best case scenario– this problem ONLY cost the investor a full price sale, $500, and four months of waiting.

Worst case scenario– a lost sale, eight months and $10k-$15k.

The REAL Solution

So what would you do?

Well this investor has no problem holding the house. He can:

- Rent it to a tenant;

- Lease-option to someone with an option premium;

- Drop the price for a cash buyer willing to overlook the title problem; or

- Sell the home with owner financing, to someone who won’t care about an encroachment exception.

But he has all those options because he has multiple exit strategies.

What would YOU do?

- What if you used all your capital to buy and rehab a house, expecting to get repaid and make a profit in a month?

- What if you borrowed hard money and had to repay it (with interest and points) before the utility company even reviewed your initial application?

- What would you do if the ultimate cost of fixing the encroachment exceeded your profit in the deal?

How to Prevent the Problem

So, how do you make sure this never happens to you?

I have no idea.

Unfortunately, I don’t see any way to avoid stepping on this hidden land mine.

As a real estate attorney, I’ve seen PLENTY of encroachments on surveys that ended up killing a financing deal. It happens way more often than anybody would expect. Houses built on a boundary line. Pools that encroach. Fences that are not straight.

But this is the first time I’ve seen it on a relatively new house in a platted subdivision with a reputable builder.

And I have no idea how the investor would have been able to spot the problem before the sale.

This is just one of the inherent risks of buying foreclosures….

I’d love comments or suggestions if anybody knows how to avoid this trap…

David