Nothing says “future distressed seller” like an Accidental Landlord.

Becoming a landlord by choice can be an excellent, intelligent financial decision.

But turning into a landlord because the property you thought would flip quickly just couldn’t sell…. Well that usually just sucks.

Too many investors screw up the calculation on their acquisition price or rehab costs, and then find themselves with no choice but to rent out the property and mitigate the damage. Or they found a title problem. Or a foundation issue that doesn’t impact safety, but prevents a sale. In these cases, the flip usually needs to become a rental.

A cash investor usually has no problem doing this. Even accounting for professional property management, property taxes, insurance and maintenance bills, most cash investors are going to have positive cash flow at the end of the month with a rental property.

The problem is when you used leverage to buy that flip.

Most people don’t believe this, but even with a hard money loan, you can make a nice profit off of a rental property. IF you were conservative with the loan amount, IF you had enough skin in the game, and IF you don’t have a short-term balloon.

So what’s an Accidental Landlord to do? Here are some Emergency Tips:

Rent Quickly– the longer the house sits empty … or the longer you wait to list it or market it as a rental … the less likely you are to make a profit. So market as a rental as soon as you realize that’s the only viable option.

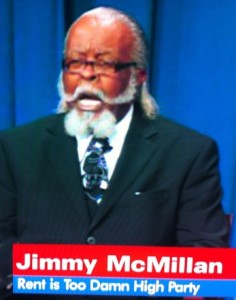

Price it Right. Then price it right. This goes hand-in-hand with Rent Quickly. Do some quick market research, see what the rental comps are… then price 10% below the market to get someone in right away. Waiting a few months to rent the house out will hurt a lot more than dropping the rent right away.

Rent to the Right Tenant. Losing a tenant (or cleaning up after one who trashed the place) is a sure way to kill profits. Screening takes time and money… and requires experience. But it is a smart investment to do a background check and credit check. You may not care if they were 30 days late on a Visa bill…. but you want to make sure your prospective tenant hasn’t left a trail of jilted landlords.

Consider Professional Management. We are a DIY nation. But are you cut out to be a landlord? Do you like early calls on a Saturday? How will you handle the inevitable emergencies? Do you feel comfortable with the screening, billing and collecting process? Managing tenants is a BUSINESS. Are you set up for that? If not, find a good property manager. Delegate.

Talk to an Accountant. You need to know what you can and can’t expense on a rental property. If you are used to flipping, you may not have a clue how depreciation works. But it’s an important part of the profit equation for all buy-and-hold strategies. And you have to recapture depreciation when you sell, so you might as well learn how to benefit from it. You also need different record keeping for your rentals than for your flips. So don’t forget to call the CPA.

Talk to a Lawyer. Sure, you can use an off-the-shelf lease agreement. Just fill in the blanks and hope for the best. But do you understand your state’s landlord-tenant law? Do you know the rules for escrowing a security deposit? Or what notice you must send for non-payment? Or what the Fair Housing Act requires? Again, most flippers try to get by without a lawyer on the team (except for at closing). Landlords always need competent legal counsel.

Talk to a Lawyer. Sure, you can use an off-the-shelf lease agreement. Just fill in the blanks and hope for the best. But do you understand your state’s landlord-tenant law? Do you know the rules for escrowing a security deposit? Or what notice you must send for non-payment? Or what the Fair Housing Act requires? Again, most flippers try to get by without a lawyer on the team (except for at closing). Landlords always need competent legal counsel.

Call your Insurance Agent. Make sure the policy you bought to cover your rehab and flip will work. It usually won’t. You need to insure the property against damage and yourself against liability. If a guest of your tenant gets hurt… you will get sued. And you want to make sure your tenant understands they have to insure their stuff—that’s not usually covered under your policy.

Call your Insurance Agent. Make sure the policy you bought to cover your rehab and flip will work. It usually won’t. You need to insure the property against damage and yourself against liability. If a guest of your tenant gets hurt… you will get sued. And you want to make sure your tenant understands they have to insure their stuff—that’s not usually covered under your policy.

What other tips do YOU have for an Accidental Landlord? What does a flipper need to know if they suddenly find themselves with a rental property?

Please leave a Comment below!