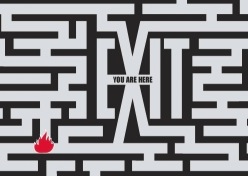

What is an Exit Strategy? It is simply your plan for getting rid of what you just bought at the foreclosure auction. Smart investors have as many exit strategies as possible. Each property that comes up for sale at an auction is going to be different– different age, size, neighborhood, etc. And each property therefore has a different ideal exit strategy.

Smart investors have as many exit strategies as possible. Each property that comes up for sale at an auction is going to be different– different age, size, neighborhood, etc. And each property therefore has a different ideal exit strategy.

The more strategies you have at your disposal, the more versatile you are in bidding. If you get locked into one way of moving a property, you will miss lots of opportunities. You will pass on houses that could make money, just because they don’t fit your method of unloading the house.

While there are plenty of variations, the basic foreclosure exit strategies are:

- Wholesale Flipping

- Retail Flipping

- Owner Finance

- Hold and Rent

Wholesale Flipping

Wholesale Flipping

Wholesale flipping just means you buy the foreclosure property and flip it to another investor. Wholesaling is generally a fast and painless way to make quick cash, and is a great way for a beginning investor to feel out the market.

However, wholesale flipping with foreclosures is considerably riskier than wholesale flipping in other areas of the distressed real estate market. Unlike wholesaling an REO or short sale, the investor who flips a foreclosure is undertaking all the risks of the foreclosure sale process– title issues, objections, delays, etc. The foreclosure wholesaler also needs to have a considerable amount of capital, because you must pay cash at the foreclosure sale, and then make your money back when you flip to the investor.

But once you learn the ropes, foreclosure wholesaling can be a great tool– even for the experienced investor. The paycheck is a lot less– usually just a few thousand dollars. But you make a quick profit and get your money back in the game. Would you rather make $5k on a wholesale deal in 5 days or make $30k on retail flip in 60 days? By wholesaling, your capital is again available to buy the next deal and you get paid quickly.

So how do you find investors to flip your wholesale deals? Network. Talk to people at your local investors association, your competition at the auction, real estate agents, etc. Ask at your title company. Call the “I buy houses” bandit signs. Place an ad on Craigslist. Talk to as many people looking to rehab and flip as you can. As a wholesaler, these are your retail buyers.

Retail Flipping

Retail Flipping with foreclosures is what most people do. Buy the house… fix the house… sell the house. You sell to the end user… the retail buyer.

You have to make all the decisions about the rehab. You have to market and sell the house. But retail flipping is going to make you the most amount of cash (although it is not the quickest cash, nor is it going to build wealth).

In today’s market, a fair number of home buyers at the retail level are going to be cash buyers. But the majority are going to finance their purchase. FHA and USDA loans are the most popular right now. So you MUST know the FHA and USDA loan requirements if you are flipping to someone who is going to borrow money. You need to know what you can contribute at closing, what type of inspections will be done, and how to market to these buyers.

Rehabbing the retail flip is the way you add value. But how much value should you add? Almost all foreclosures need new paint and carpet. But what do you do after that? A green lawn and fresh flowers always make a great impression. A new front door or shutters can add a lot of curb appeal inexpensively.

New cabinets? New roof? Maybe. But it is easy to quickly spend too much on a rehab, and you need to watch your expenses carefully. You only want to spend money on repairs or improvements that are going to return your expense plus make you profit. The house has to be to code, must pass its inspections, and should be at least as good as the comparable homes in the neighborhood. But be careful to not overdo the rehab on a retail flip.

Owner Finance Flipping

Selling to a retail buyer who cannot line up financing? Want to sell a crappy house for top dollar? Owner financing is the way to go.

Owner financing is just being the bank for your buyer. You sell the home and finance the purchase. The buyer walks away from closing with a deed, and you end up with a promissory note and mortgage. The note is the buyer’s promise to pay, and the mortgage is the lien on the property if they stop paying.

Owner financing allows you to sell houses that would be difficult to move as flips– usually the lower end, older houses. But it uses up more cash. Unlike the flip, when you sell with owner financing, you don’t get your money back quickly. But sometimes that’s a good thing. Flipping can give you a great income. But it’s a job. Stop showing up for work, and you stop making money. The next paycheck comes from the next deal.

Owner financing helps build passive income and long term wealth. Once you’ve made the sale, you sit back and collect monthly mortgage payments. Sure, you have to check to make sure they paid the taxes and insurance, but generally collecting payments is pretty simple.

If you need to turn that note into cash later on, you can liquidate the note by finding a note buyer. Note buyers want to see a solid, seasoned note. That means you need to screen your buyers the same way a note buyer will, checking credit, getting a good down payment, and only selling to someone who can afford the payment. Then you need to keep good records, tracking the date and amount of every payment. A note buyer is often going to want a discount from the face amount, and the better the payment history and your record keeping, the lower the discount…. the more you make.

Hold and Rent

Rentals are the true road to wealth. Lots of hassles… but lots of rewards.

When you wholesale, flip or owner finance, you’ve locked in your profit. You’ve determined the maximum amount you will ever make on that particular property.

Rentals let you take advantage of long term appreciation. Which, even though its been REALLY hard to come by the last five years, will eventually return to most markets.

The classic example of “nothing down wealth building” through rentals is to buy 10 homes, all with bank loans. Rent all 10 out, making sure the rent covers your mortgage, taxes, insurance and other expenses. You aim for a small monthly profit, but the important thing is just to avoid negative cash flow. Then 10-15 years later, after all the homes have significantly appreciated, you sell half of them and use those proceeds to pay off the mortgages on the remaining homes. Now you have 5 paid-for houses, each generating a nice monthly income. That’s enough to make a decent retirement income for most people!

For rentals, I focus on nice, older homes in good solid neighborhoods. These are the homes that are going to maintain and build value in the long run.

I always consider the rental potential of a house if I think we might have trouble flipping the house for top dollar. It’s a great exit strategy to have when a flip doesn’t work out. It lets you buy marginally profitable houses at the foreclosure sale, knowing you can always rent the property instead.

I also consider keeping tenants in place whenever we buy an occupied foreclosure home… which happens more and more as banks realize they don’t want the hassle of dealing with tenants. The Protecting Tenants at Foreclosure Act requires us to honor the term of written leases or give 90 days notice to tenants without a lease. As long as the person is a bona-fide tenant and can pay fair market rent, I will always consider renting our foreclosure purchase to the in-place tenant.

As with owner financing, rentals tie up your cash. The numbers usually only make sense for someone investing their own money, or cheap bank financing. Hard money and private money is just too expensive to avoid a negative cash flow with most rentals.

BUT. Being a landlord isn’t for everybody. I have a staff to deal with tenant complaints, repairs, evictions and all the other hassles, so I tend to forget what a pain in the ass it can be. When you are handling those problems on your own, you need to be educated and experienced. Don’t become a landlord by accident.

Conclusion

The well armed foreclosure investor will have as many exit strategies as possible. The more versatile you are, the more homes you can buy, and the more money you can make. Determining when to wholesale or flip, when to owner finance or rent… those are important decisions that can be the difference between making money and losing it.