I love buying foreclosures with cash. Nothing beats the flexibility and certainty. But financing can also be an incredible leverage tool.

With flipping, borrowing usually works well. Buy, fix and flip quickly, and you earn easy profits, even with the high costs of a hard money loan.

But what about the buy-and-hold investor? The landlord looking for steady income? Should leverage ever be a part of the equation?

I used to think that it was a really bad idea to borrow for buy-and-hold. But I’ve changed my mind.

When you run the numbers…actually do the math… financing makes a lot of sense for income producing property. The leverage REALLY helps the returns.

Now… where do you get a loan? Credit today is tighter than hipster jeans. And even if you qualify for investor financing, Fannie Mae caps the number of properties you can finance as an investor.

Now… where do you get a loan? Credit today is tighter than hipster jeans. And even if you qualify for investor financing, Fannie Mae caps the number of properties you can finance as an investor.

So, for most investors, the only real financing option is hard money or private financing.

That’s usually 12% money (or higher). So how can you possibly make money on a rental if you are paying loan-shark rates?

Well… the math is actually pretty simple. Hard money works.

It turns out you can STILL make money on your buy-and-hold properties, even if you are borrowing 12% money…actually, you make MORE money than if you paid all cash.

SIDE NOTE: This is GREAT for people with Self Directed IRAs. You can buy rental properties with leverage. While banks won’t give you the “non-recourse” loan the IRS requires, a hard money lender is usually happy to lend based on the value of the property– with a large down payment. And again, the math gives you a much better return on investment.

Now, first you have to accept the difference between Return on Investment (ROI) and Cash Flow.

Because with hard money, you are really going to dent your monthly Cash Flow… but you are going to increase your overall ROI. This just means you have to look at the long term, not the short term. Of course, since most buy-and-hold strategies are designed to look at the long term anyway….

In Florida, I can readily find hard money at 12% interest. Usually, that’s a 50% LTV  (Loan to Value)… I have to make a 50% down payment, and can borrow the other half. The hard money lender wants a short amortization schedule… full repayment of all principal and interest in 100 months. (Or they want a short term balloon, which requires a refinance in a couple years… not a great long term plan.)

(Loan to Value)… I have to make a 50% down payment, and can borrow the other half. The hard money lender wants a short amortization schedule… full repayment of all principal and interest in 100 months. (Or they want a short term balloon, which requires a refinance in a couple years… not a great long term plan.)

Again, 12% sounds like an exorbitant rate and results in a really high monthly payment, right?

So… how can the hard money loan POSSIBLY be better than all cash?

Here’s the simple math:

EXAMPLE:

$100,000 Property

$1,200 Monthly Rent

- Assume 4-months of rent to pay property manager, taxes, insurance, vacancy and other expenses. (Conservative, but simple).

- Ignore depreciation, cost allocation, and other tools that actually make financing even more attractive.

- Ignore the possibility that rent and property values should go up over time- that’s common to both calculations.

Cash Return on $100k property rented at $1,200/month:

$1,200/month x 8-months = $9,600 / $100,000 invested = 9.6%

Cash Return using 100 month / 12% interest / 50% down payment:

$50,000 Loan: 100-month amortization=$793.29 per month ($9,520 per year)

$1,200/month x 8-mos. = $9,600 – $9,520 loan = $80.00 / $50,000.00 = .0016%

Ugh… which would you prefer? A 9.6% return… or a tenth of a percent?

Hold on a minute.

So far, we just calculated your cash flow as a percentage of the amount invested. It’s not an accurate picture of your overall ROI.

Because every month, your tenant is helping you pay off the hard money lender.

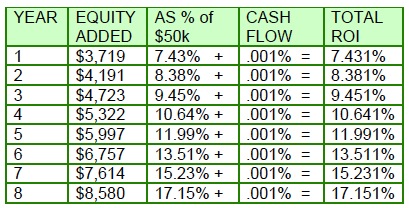

On a 100 month amortization, a huge chunk of the monthly payment is reducing the loan principal. And that reduction is adding to your equity value (independent of any appreciation in rents or the property value). Here’s what your $50k loan looks like over time:

For the mathematically challenged, this looks like a bunch of gobbledygook.

What it shows is the investor who borrowed hard money (even at an outrageous 12%) makes a little less ROI in the first three years than his “all cash” counterpart.

But then in the 4th year, the return for the leveraged investor passes the All Cash investor… and it steadily gets better.

Over the course of 8 years, all other factors being equal, the Investor with a hard money loan made an average of 11.72%, while the cash investor made a steady 9.6% return.

That means the leveraged investor had a 22% better ROI than his all cash counterpart.

BUT…

The REAL difference is what happens at the end of the loan.

Because the leveraged investor could afford TWO houses with his 100k (two $50k loans with $50 down payments).

So after 8 years, the leveraged investor has two houses, both paying rent, both with fully paid off loans.

And the ROI for the leveraged investor is thereafter DOUBLE that of the cash investor.

Let’s Summarize your choices:

1. An all cash purchase of a rental home. Pay $100k, rent it for $1,200 a month, and make a steady 9.6% return on investment after paying all property management, taxes, insurance and maintenance bills. (Plus the rents and property value hopefully go up over time)

OR

2. Borrow 50% hard money at 12%. Buy two houses. Enjoy an average of 22% higher ROI over the first 8 years…. then 100% higher ROI than under the cash option (and still enjoy appreciating rents or property values)

The Moral of the Story?

Even leverage at loan-shark rates can compound the returns for long term, buy-and-hold foreclosure investors!!