I love political commentary. Especially from those who identify and label bullshit.

One of my favorite guys to listen to is Alan Kelly (@playmakeralan), the CEO of Playmaker Systems and author of The Elements of Influence. He does a great job of weekly breaking down political bullshit on The Morning Briefing- POTUS.

and author of The Elements of Influence. He does a great job of weekly breaking down political bullshit on The Morning Briefing- POTUS.

Alan frames his discussion in terms of “running plays”. The plays he discusses are not limited to politics– they work in business as well. They are the methods of advancing ideas, controlling markets, positioning products, and beating the competition.

In his system, Alan identifies 28 “Plays” (a stratagem, one of a finite set of discrete strategic maneuvers). They are each labeled, defined and thoroughly discussed. If you love strategy, game theory, and competition, get the book and visit the site.

Here are 9 of Alan’s Plays and how we regularly see them run at a foreclosure auction.

PASS-Exit the Marketplace. The strategic withdrawal from the marketplace. From time to time, an investor’s war chest gets empty… or close enough. Rather than show up at the sale and risk making a wrong move, the investor can take a vacation, focus on other investment strategies, or just go to the sale and hang back. This strategic retreat allows the investor to live to fight another day. Retreat… regroup… redeploy.

PASS-Exit the Marketplace. The strategic withdrawal from the marketplace. From time to time, an investor’s war chest gets empty… or close enough. Rather than show up at the sale and risk making a wrong move, the investor can take a vacation, focus on other investment strategies, or just go to the sale and hang back. This strategic retreat allows the investor to live to fight another day. Retreat… regroup… redeploy.

PING-Hint and Hide. The oblique reference or suggestion, enabled either by a player’s mere presence or its implied interests in topics, events and developments. The investor who wants to control a segment of the auction may strategically bid on properties that don’t fit his investment profile… just to throw others off. Showing interest in everything can mask the investor’s true intention. Bidding on farm properties when you are a single family home investor. Buying the raw land out from under the developer. These are not direct attacks, but simple hints that a competitor needs to look out for you.

RED HERRING–Send Off Course. Action drawing a competitor away from its preferred position or intended course of action. How many times have you heard investors at an auction asking each other about a sinkhole, or whether the property was occupied, or whether the roof was shot. This might be genuine curiosity… or it could be a Red Herring. The beauty of this Play is that you never know…

RED HERRING–Send Off Course. Action drawing a competitor away from its preferred position or intended course of action. How many times have you heard investors at an auction asking each other about a sinkhole, or whether the property was occupied, or whether the roof was shot. This might be genuine curiosity… or it could be a Red Herring. The beauty of this Play is that you never know…

JAM-Gum Up the Works. Disable or disorganize another player’s activities or communications. Investors love to distract their competition during the sale. Asking them questions, calling their phone, or otherwise running a pick play to prevent them from bidding on the property up for grabs.

CHALLENGE- Exhort Others to Action. The public appeal, suggestion or demand by a player. Investors love to push their competition off a property. Sometimes directly, sometimes indirectly. The open challenge “Come on, you know you want this one” can get in another bidder’s head just long enough that they don’t bid on time…. or even better yet… push them into buying a mistake.

BAIT-Taunt, Provoke a Reaction. The overt provocation of another player through action or information. People who are taunted get angry. Angry bidders make mistakes. Provoking the competition usually results in them making a poor choice. The Information Bait is a little more subtle, but just as effective.

DRAFT- Follow, Feed-Off, Then Try to Pass. The attempt to feed off another’s energy, innovation or best practice with the intent of overtaking. At foreclosure auctions, we call this Piggybacking… the investor who doesn’t do their homework, but simply outbids someone who knows what they are doing. It takes less energy to draft… but its also easier for the lead car to put you in the wall when you try to pass to the outside.

DRAFT- Follow, Feed-Off, Then Try to Pass. The attempt to feed off another’s energy, innovation or best practice with the intent of overtaking. At foreclosure auctions, we call this Piggybacking… the investor who doesn’t do their homework, but simply outbids someone who knows what they are doing. It takes less energy to draft… but its also easier for the lead car to put you in the wall when you try to pass to the outside.

PLANT- A Secret Ally. A trusted and confidential ally- usually disguised or undisclosed to the opponent, who is placed to seed information. This doesn’t work well at small auctions, and a plant can only be used once per player. But we often see new plants at our sale conducting whisper campaigns. Especially when new bidders with lots of cash show up. Be cautious of the friendly person chatting you up at the sale…

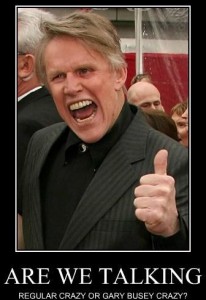

CRAZY IVAN-Turn and Attack Unexpectedly. The deliberate invitation or initiation of an attack. Crazy Ivan is one of my specialties… the suicide maneuver for tactical advantage. Remember Hunt for Red October, where they spin the sub? I love leaving everybody in the room wondering what the hell I am thinking. We buy so many houses that it starts to get predictable, which invites Drafting. Crazy Ivan just keeps it real…

CRAZY IVAN-Turn and Attack Unexpectedly. The deliberate invitation or initiation of an attack. Crazy Ivan is one of my specialties… the suicide maneuver for tactical advantage. Remember Hunt for Red October, where they spin the sub? I love leaving everybody in the room wondering what the hell I am thinking. We buy so many houses that it starts to get predictable, which invites Drafting. Crazy Ivan just keeps it real…

So what other games and plays do you see at foreclosure auctions? What works… what doesn’t?

Please respond in the Comments Below!