Today, we continue our series on the “10 Commandments of Foreclosure“. (See Part One Here) (Part Three Here). Not written in stone, but you ignore these rules at your peril:

- Know thy Process

- Know thy Property

- Know thy Title

- Know thy Parties

- Know thy Occupant

- Know thy Judge

- Know thy Repairs

- Know thy Exit Strategy

- Know thy Buyer

- Know thy Closer

Part One covered #1-#3

This post (Part Two) covers $4-#6

Part Three cover s#7-#10.

When we are done with this series, you should be fully prepared to bid at a foreclosure sale… or you should be too scared to bother.

—

#4- Know Thy Parties

Judicial foreclosures have at least one Plaintiff (the party bringing suit) and one Defendant (the party being sued). But often there are many names on both sides of the case.

PLAINTIFF SIDE

On the Plaintiff side, you might see:

- The lender

- The successor in interest

- The servicer

- The nominee

- The trustee

- The certificate holder

- The securitization pool number, etc.

All of this is valuable information. But primarily, you just want to know the party bringing the foreclosure has the legal right to collect. When you do your title search, you will usually find the Plaintiff bringing the lawsuit is not the lender on the original note and mortgage (credit unions and small local banks are the primary exceptions). The first step in your title search is to link the original lender to the party foreclosing. This can get very confusing, but it is critical to ensure you are buying a property that has been properly foreclosed.

Think about your own home loan. You may have gone to your local bank, closed on a loan… then that loan was sold within hours. The next month, you got a notice to send your payment to a servicing company… a different company than the one that bought the loan from your bank. And that servicer may have then been acquired by another company, and you suddenly had to send the payment somewhere else.

Well, things were WAY crazier with the low quality, high risk loans that proliferated during the boom (and which still make up the majority of foreclosures). Go read about collateralized debt obligations, mezzanine tranches, GSEs and credit default swaps, and you might see why the big banks started playing shell games with the mortgage note.

Despite these bankster shenanigans, you have to track the note from the party bringing suit all the way back to the original loan. If the assignments are not recorded in the official records at the county level, they might be in the court file as an attachment to the complaint or motion for summary judgment. Or they may not exist at all, in which case the judge never should have signed off on the foreclosure sale. Shockingly, when you ask a judge to handle several thousand additional cases a year, some things fall between the cracks.

Despite these bankster shenanigans, you have to track the note from the party bringing suit all the way back to the original loan. If the assignments are not recorded in the official records at the county level, they might be in the court file as an attachment to the complaint or motion for summary judgment. Or they may not exist at all, in which case the judge never should have signed off on the foreclosure sale. Shockingly, when you ask a judge to handle several thousand additional cases a year, some things fall between the cracks.

If you don’t see a trail of ownership on the note, proceed with caution. We’ve taken the gamble before, and been able to track down the right documents later… but that’s incredibly risky. Sometimes you can connect the dots without recorded assignments– if you have a working knowledge of which banks are successor by merger or acquisition to other banks. GMAC is now Ally. IndyMac is OneWest. Wachovia is Wells Fargo. And so on….

One plaintiff name you won’t see as often as you did a couple years ago is MERS (Mortgage Electronic Registration Systems). Back in the early 1990s, the banks created MERS as a “nominee”, so they could get around the traditional assignment recording requirements at a county level. The basic idea was lenders could buy and assign notes as part of their pools without having to record the assignments. Then MERS would simply file the foreclosure if required. Shockingly (heavy on the sarcasm there) the big banks misused MERS, and as the inadequacies of the model were exposed, states started requiring the actual lender or servicer of the note to bring suit as the Plaintiff. But you will still see MERS named as a defendant on second mortgages pretty regularly.

You will also learn, with time and experience, which Plaintiffs tend to discount foreclosures below the judgment amount. After months of spreadsheets, I gave up trying to predict which Plaintiffs will discount with any precision. But over time you will start to spot trends. Keep in mind a single servicer might represent numerous investor pools, and every pool has a different set of discount guidelines– the same reason mortgage modifications and short sales are a huge time suck. Even when the servicers and pool are identical, you may have different asset managers just making different decisions. The BPO may have come back on one property and not another. Or the foreclosure attorney forgot to give the bidding representative updated numbers. So you will get used to seeing two similar properties, with the same plaintiff, and the bank bids all the way to full judgment on one case, while discounting heavily on the next.

Defendant Side

On the Defendant side, you might see:

- The Borrower

- The Borrower’s spouse

- The Tenant

- Jane Doe/John Doe (unknown)

- Estates/Guardian/Successor

- Lienholders/Creditors

- HOA/Condo association

On the Defendant side, you start by making sure anybody with an interest in the property or a lien against title has been included in the lawsuit. If your title search shows a lien and the lienholder is not a defendant, that lien is not getting wiped out by the foreclosure. If the property is owned by a husband and wife, and the wife isn’t named… you have a problem. Buy that property at a foreclosure sale and you do not have marketable title. You can’t sell the property with title insurance (which eliminates flipping to somebody borrowing money).

The sneakiest of these liens is when the first mortgage and second mortgage are held by the same bank. The bank doesn’t have to name itself to wipe out the second mortgage if it already owns the second mortgage– the two loans can simply merge when the bank marks the second mortgage satisfied. But if YOU buy the property at the foreclosure sale… well you don’t own the second mortgage, now do ya’?

On the other hand, you will often see the same bank as both Plaintiff and Defendant– why would that happen if they can just disregard a second mortgage? Well, if the bank services the first mortgage for one pool and holds the second mortgage on its own, the bank is required to wipe out its own second mortgage to give clear title to the owner of the first mortgage that it services. Yup— often the Plaintiff is hurting its own interests to fulfill its fiduciary obligations to a client (You are not permitted by law to feel sorry for them, though…).

You also want to carefully note any tenants listed as defendants, as tenants have a variety of protections under federal, state and local laws, as discussed in the next section (Know thy Occupant).

—

#5 – Know Thy Occupant

Ideally, you pull up to the house and see a “Field Asset Services” sticker on the window or garage door telling you the property is being maintained …. and it’s vacant. The house is empty, the carpets are vacuumed, the yard is mowed, and the key you took from the lock-box on your last foreclosure purchase fits the lock on the front door. Perfect.

For the past few years, that actually happened more than you would expect. Now, things have changed. Increasingly, the banks are keeping the cream-puffs to sell on the REO market. They discount the crappy houses at the foreclosure sale. They also discount the occupied houses.

For the past few years, that actually happened more than you would expect. Now, things have changed. Increasingly, the banks are keeping the cream-puffs to sell on the REO market. They discount the crappy houses at the foreclosure sale. They also discount the occupied houses.

If the house is occupied, the next step is to determine if it is occupied by the owner, a tenant, or someone else. Your occupant determines how long it will take to get possession of the property after the sale.

- Owners. Usually pretty easy to kick out. Depending on your judge. Some judges require a separate case to evict any occupant. Others will automatically issue a Writ of Possession to kick out an owner, since they have already gone through the process. IF they don’t file an appeal, a bankruptcy, a sale objection, etc.

- Squatters. Happens more than you would think. People move into an abandoned house, pay no rent, but don’t seem excited about leaving once you buy the house. A surprising number of Squatters think they get the same protection as a Tenant. And a surprising number of judges don’t seem to understand the difference either. Your mileage will definitely vary with Squatters.

- Tenants. Tread with Extreme Caution. Used to be, tenants got kicked out just like owners. Not any more. In 2009, Congress passed the Protecting Tenants at Foreclosure Act. Then in 2011, the Dodd-Frank Act amended and clarified the Act. Tenants also may have state or local rights (or even judge-specific rights with no basis in any law….). This is a complicated topic, deserving of its own post… or more likely its own textbook. But the quick version is that “bona fide” tenants get at least 90 days notice before eviction. Tenants with a written lease get the entire term of their written lease. So you might think you get the house immediately as the new owner. Not true if you have tenants in place.

So how do you know who is occupying the home? Ask. Knock on the door and say “I was wondering if the home is occupied?” The answer to that is always a puzzled look– I came to the door didn’t I? Then ask “are you the owner”? Tenants will tell you right away they rent. Owners may waffle a bit, but usually tell you they are the owner.

I know…. you can’t imagine a stranger knocking on your door and getting a polite answer from you. But the owners and tenants of foreclosure houses know “the knock” is coming. Sure, you can call the electric company, talk to the neighbors, or do some online research. But asking is a lot simpler.

While you are talking to the occupant, what else can you find out? What shape is the home in? Any major problems? Ask a tenant what the landlord hasn’t fixed that is really bugging them…. and expect an earful. Landlords who keep collecting rent during a foreclosure have a nasty tendency to put off all repairs and maintenance.

We also ask occupants if they are aware of the foreclosure sale and what their plans might be. Just to see if they lie. And a bunch of people do lie. When the occupant of a foreclosure house tells you they don’t know anything about this foreclosure thing… that’s a lie. You just can’t ignore the volume of legal documents getting mailed to the house and posted on the front door. The occupant who lies to you about even knowing about the foreclosure is going to require extra effort to evict later on… count on it.

—

#6- Know thy Judge

I don’t mean you have to be friends with the judge. I mean you (or your lawyer) have to know how a specific judge will react to certain situations and arguments. And I want to know who our judge is on a particular case BEFORE I buy the property at the foreclosure sale.

Here’s an example of why I want to know the judge assigned to the case. In our judicial circuit, one judge handling foreclosure cases automatically has the Clerk of Court issue a Writ of Possession, without further court order, as soon as the Certificate of Title is issued. With this judge, tenants have to go to court and obtain an order to stop the possession action, otherwise it happens automatically. And this judge doesn’t readily give the benefit of the doubt to someone who has already received umpteen notices about the foreclosure case over the past two years. So in all but rare circumstances, we have automatic possession of the home within several days of getting title.

However, a different judge, in the same circuit, will not allow the Clerk to issue a Writ of Possession until the buyer of the foreclosure property files a motion, and the judge holds an evidentiary hearing. And then this particular judge is very sympathetic, labeling anybody in the home a Tenant, entitled to at least 90 days notice, even if they don’t meet the definition (you know…. somebody who is actually PAYING RENT…). So you may not get possession of the home you bought for 3-4 months after you expected. Hope you weren’t actually trying to make a profit on that foreclosure…

Same circuit. Different judge. VERY different results.

We also often face objections to the sale. The borrower has one last chance to save their home, and they use it regularly. In Florida, the law allows 10 days for pretty much anybody associated with the case to object to the sale. Legally, the objection is supposed to be about a technicality of the sale itself- like the published notice had the wrong date… or wasn’t published at all. In practice, the borrower isn’t objecting with a valid reason… they are just buying time.

Again, different judges will deal very differently with these objections. One foreclosure judge in our circuit will overrule a defendant’s objection the same day it hits his desk… no response needed, and no delay at all in getting title or possession. But another judge requires a hearing on every objection, and for some reason this judge’s docket is always full (with objection hearings?) So depending on the judge, you face a delay of a month… or no delay at all.

Different judges will give you very different results. Judges have wide latitude and discretion in deciding the issues involved in a foreclosure case, because these are cases heard in equity. So a judge’s sense of fairness really comes into play. And the judge assigned to your case can be the difference between making money and losing money on a particular property. So know your judge.

—

SUBSCRIBE NOW AND DON’T MISS:

10 Commandments of Foreclosure –PART THREE–

#7- Know thy Repairs

#8- Know thy Exit Strategy

#9- Know thy Buyer

#10- Know thy Closer

—

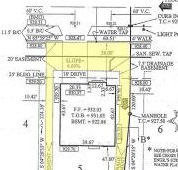

Obviously, nobody gets a survey of the property before they buy at the foreclosure sale. Not enough time, and the expense isn’t warranted, especially considering all the potential properties at the sale. I’m not even sure if a surveyor can take your order if you have no interest in the property…

Obviously, nobody gets a survey of the property before they buy at the foreclosure sale. Not enough time, and the expense isn’t warranted, especially considering all the potential properties at the sale. I’m not even sure if a surveyor can take your order if you have no interest in the property… Best case scenario– this problem ONLY cost the investor a full price sale, $500, and four months of waiting.

Best case scenario– this problem ONLY cost the investor a full price sale, $500, and four months of waiting.