Pam Bondi - FL AG

As a part of the $25 Billion national mortgage foreclosure settlement with the Big Banks, Florida is getting about $300 Million to keep homeowners out of foreclosure. That part of the cash HAS to be spent on foreclosure prevention programs.

Florida’s Attorney General, Pam Bondi, is looking for suggestions on how to dole out these funds.

The hitch is, the money MUST be spent on foreclosure prevention programs like housing counselors, assistance hotlines, mediation programs, legal assistance, anti-blight projects and consumer protection programs.

Guess what? Florida has already tried these… with very limited success.

Mediation Program Terminated

Back in 2009, Florida courts started requiring lenders to participate in mediation prior to taking back a home in foreclosure. Every homeowner was given a chance to sit down at mediation before facing a judge.

In December 2011, the Florida Supreme Court terminated the program. Turns out, only 4% of cases eligible for mediation ended in any kind of a settlement, and most of those cases ended in the homeowner signing a “deed-in-lieu” back to the bank.

Foreclosure Hotline Defunct

Back in 2008, the Florida Bar set up a hotline to help homeowners facing foreclosure, staffed by hundreds of volunteer attorneys offering pro-bono services through the Florida Attorneys Saving Homes initiative. Attorneys would help negotiate with the lender at no cost to the owner.

The hotline number is out of order, and the website has been hijacked by spammers. But luckily, Google shows 1.6 Million other results for “Florida foreclosure hotline”. So there is no shortage of places to get advice…

Anti-Blight Projects

Ever heard of “NSP houses”? The Neighborhood Stabilization Program is a muti-phase federal give-away to “stabilize communities that have suffered from foreclosures”. The Feds gave several billions to state and local governments in block grant money. BUT, the feds required the locals to buy houses from the Big Banks at full asking price (that’s right.. it was actually another Wall Street Bailout, despite the name).

The homes could then be rehabbed or demolished, to help eliminate blight. But the funds COULD NOT be used to directly help buyers or people in foreclosure.

funds COULD NOT be used to directly help buyers or people in foreclosure.

Unfortunately, after a few years, everyone finally realized if you buy an REO at full price, before the market has hit bottom, then use governmental contractors for the rehab, the homes end up being so expensive that nobody will buy them on the back end. So hundreds of NSP houses that COULD have gone to investors and then new owners or tenants are instead sitting empty…. not exactly stabilizing the neighborhoods.

Housing Counselors

Just last month, HUD announced another $42 Million in housing counseling grants to 468 organizations, with the goal of helping people keep their homes.

But that money goes to staff positions… not homeowner relief. And while $42 million is a lot… it averages out to a just a single staff position for each agency. And how many counselors do you really need to tell people that if they can’t afford their home, foreclosure is inevitable?

You Really Want to Prevent Foreclosures?

The “Foreclosure Crisis” is entering its 5th year.

At this point, how many people facing foreclosure really need a lawyer, counselor, mediator or hotline to educate them on their options?

People losing their homes to foreclosure in 2012 fall into one of two camps. They either:

- Can’t afford to make a mortgage payment (lost a job, got sick, etc); or,

- Are Strategically Defaulting because they are hopelessly underwater.

There is only one rational solution for these folks.

Give up the home.

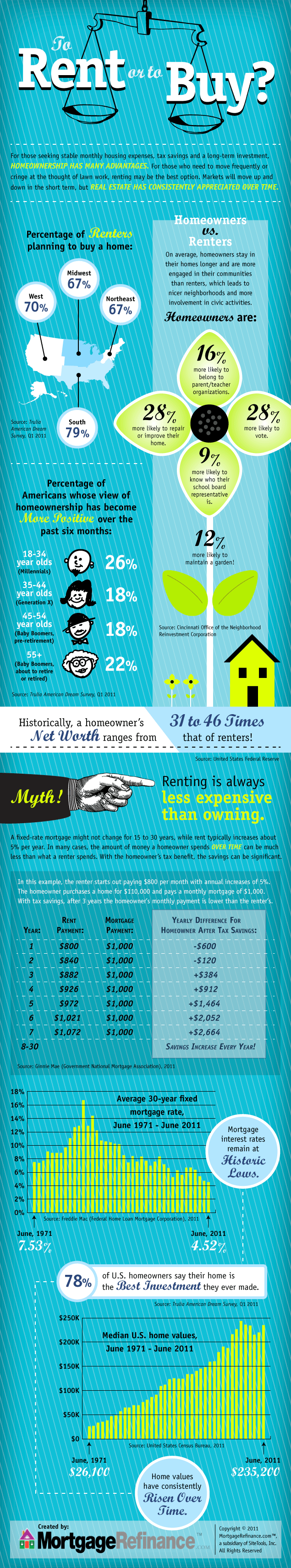

I know it’s harsh, but these people need to become renters. Home-ownership isn’t for everyone… especially, well… those who can’t afford it.

I know it’s harsh, but these people need to become renters. Home-ownership isn’t for everyone… especially, well… those who can’t afford it.

So why not use that $300 Million to convince the roughly half-million Floridians in foreclosure to give their house back to the bank and become tenants?

“Willing to sign a deed and move into a rental house? Here’s $500. You now have your first month’s rent!”

Give em’ Cash-4-Keys and turn them from foreclosure defendants to viable tenants.

In most parts of Florida, investors are buying up bank-owned properties in droves, and these investors are looking for new tenants.

In most parts of Florida, investors are buying up bank-owned properties in droves, and these investors are looking for new tenants.

A homeowner in foreclosure can move across the street into an identical house, and rent for just half of what they were paying on their 2006 mortgage.

Six months from now, the Big Banks will have all the foreclosure houses back and they can figure out what to do with all that shadow inventory. Probably sell it to investors that will fix them up and rent them out to all the new tenants.

And the foreclosure crises will be over.

Any chance whatsoever of this happening? Er…. No…. None.

But give Pam Bondi’s office a call at (866)-966-7226, and let her know what YOU think…